Introduction:

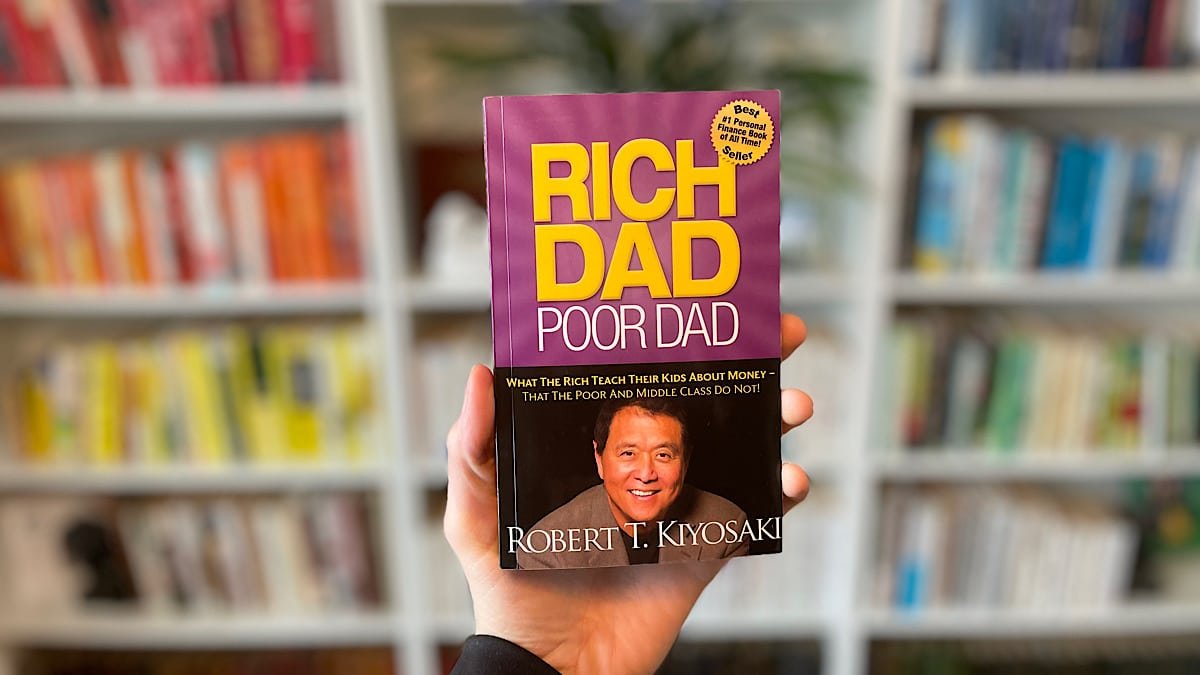

Ah, Rich Dad Poor Dad, the book that launched a thousand multi-level marketing schemes and probably convinced your cousin Dave to buy a condo in Panama. Written by Robert Kiyosaki, it’s been hailed as a financial revelation, a mindset shifter, and possibly the most effective way to make poor people feel bad about themselves since credit scores were invented.

Is it a masterpiece of financial education? Or is it just motivational fluff masquerading as advice, with the emotional depth of a TED Talk and the subtlety of a sledgehammer?

Let’s dive in.

Table of Contents

The Premise: Two Dads, One Wallet

Kiyosaki presents us with a tale of two fathers: his real dad (the “Poor Dad”), a well-educated government employee who believed in job security, pensions, and other relics of the pre-apocalypse; and his friend’s dad (the “Rich Dad”), a capitalist Yoda who taught him the ways of money, passive income, and never paying taxes if you can help it.

Spoiler alert: Rich Dad wins. Every. Single. Time. The lesson? If you want to succeed financially, stop being your dad and start being someone else’s dad. Preferably one with offshore accounts.

Core Messages: Simple Truths Wrapped in Business Casual

Despite the slightly cultish tone and vagueness that borders on evasive, Rich Dad Poor Dad does offer a few nuggets of solid wisdom:

- Assets good, liabilities bad.

A revolutionary concept, unless you’ve ever seen a bank statement. - Don’t work for money, make money work for you.

Which is very helpful advice, assuming you already have some money. Otherwise, your options are: work for money, or starve while trying to manifest passive income through sheer force of positive thinking. - Financial education is everything.

Translation: School is a scam. Read Kiyosaki instead. Or, better yet, enroll in his seminar (just $499 for the intro session, bring your own hope and desperation).

It’s like the financial equivalent of being told to “just be confident” when you’re anxious: technically correct, practically useless without context.

The Writing: Self-Help With a Side of Smug

Kiyosaki’s tone is somewhere between motivational speaker and that guy at the bar who tells you to “invest in crypto” while trying to sell you a dodgy NFT. The prose is repetitive, overly simplistic, and clearly written to be digestible by even the most financially illiterate reader – which is, I suppose, the point.

But after the 47th anecdote about how Rich Dad was basically the Warren Buffett of Oahu, you start to wonder: Is this book about financial freedom, or just a longwinded humblebrag?

And let’s not ignore the convenient vagueness surrounding Rich Dad’s identity. Is he real? Is he a composite character? Is he Kiyosaki in a moustache? Who knows. Maybe he’s a metaphor. Or maybe he’s just a legal loophole to avoid libel.

Criticism: A Pyramid Scheme in Paperback?

To be fair, not everyone thinks Rich Dad Poor Dad is the gospel according to passive income. Critics argue it lacks actionable advice, promotes risky behavior, and encourages people to ditch their jobs before they’ve figured out how to pay rent without selling plasma.

There’s also the small matter of Kiyosaki’s later ventures, which include a string of seminars, courses, and financial products that have, on occasion, been accused of being, how shall we say – a bit scammy. If capitalism had a side hustle, this book would be its vision board.

Why People Still Love It (Despite Everything)

Here’s the kicker: despite its flaws, Rich Dad Poor Dad does inspire people to think differently about money. For many, it’s a gateway drug to personal finance – a jolt to the system after years of being told that the path to success is a college degree, a 9-to-5, and a mortgage you can’t afford.

It plants the seed of curiosity. It says, “Hey, maybe you don’t have to spend 40 years in a cubicle and retire just in time for your knees to give out.” And for that, it deserves a grudging nod of respect.

Final Thoughts: Should You Read It?

Yes. But with your brain switched on and your skepticism fully engaged.

Rich Dad Poor Dad isn’t a roadmap, it’s a motivational pamphlet with delusions of grandeur. Treat it like financial astrology: it might not give you the winning lottery numbers, but it’ll at least get you thinking about how money works (or doesn’t).

Just don’t quit your job to buy three rental properties with no down payment. That only works in Rich Dad’s dreamland, or in the fevered imagination of a TikTok finance bro.

And remember: if someone tells you passive income is the key to happiness, they’ve probably got an affiliate link to sell you